Virtual data room market: Trends of 2023 and forecast for 2024

Over the recent years, the approach to data storage has evolved exponentially: from traditional physical data rooms to virtual data rooms. As the demand for digitalization grows, as well as the data security concerns, the need for adopting virtual data rooms increases as well.

This article dwells on the current state of the virtual data room market and related industries, lists key players, and forecasts the main trends for 2024.

Virtual data room market: definition, overview, segmentation

A virtual data room (VDR) is a secure online repository for data storage and distribution. Its main difference from the average cloud storage solution is the level of provided security. Virtual data room vendors take enhanced security measures to ensure users’ data privacy and confidentiality.

That’s why it’s widely used in investment banking, corporate development, initial public offering, fundraising, and such complex financial transactions as mergers and acquisitions.

Now, let’s get to the main specifics of the current virtual data room market.

Virtual data room market overview

As of the end of 2023, the virtual data room market is estimated at about $1054.67 million, according to the Virtual Data Room Market Outlook Report presented by Expert Market Research. According to them, the global market value is expected to grow at a CAGR (compound annual growth rate) of 15.11% during the 2024-2032 period and reach $3742.5 million by 2032.

That’s a slight decline in the global virtual data room market value compared to the 2022 data presented by IMARC Group. According to them, the virtual data room market was estimated at $2.2 billion in 2022.

However, there’s also another piece of the coin. Straits Research states that the global data room VDR market is valued at $2.23 billion in 2023, which is also a slight market growth from $2.18 billion in 2022.

Either way, the demand for virtual data room solutions is ongoing, and we further discuss the main drivers for that.

Overview of related markets

There are several business markets that are related to the virtual data room industry either way.

Let’s take a look at their current state.

- M&A

According to PwC, the value of M&A transactions worldwide was estimated at $1,208 billion as of the first half of 2023. In 2022, the global M&A deals value amounted to $3.4 trillion. While the decline in the M&A activity is obvious, 60% of corporate leaders still were not planning to delay deals because of the uncertain economic state.

- Investment banking

According to the Business Research Company, the global investment banking market size has grown from $153.49 billion in 2022 to $166.62 billion in 2023 at a CAGR of 8.6%.

- Fundraising

According to Verified Market Research, the global fundraising market was estimated at $625.89 billion in 2022. However, in 2023, it was projected to reach $565.2 billion, according to Statista.

- IPO

According to Ernst & Young, there were 968 IPOs with $101.2 billion of capital raised in the first three quarters of 2023. This is a 5% and 32% decline year-over-year, respectively.

- Cloud storage

According to Statista, the global cloud storage market share is estimated at $108.69 billion in 2023 and is projected to grow to $472.47 billion at a CAGR of 23% during the forecast period of 2023-2030.

What could this statistic mean to the virtual data room market? Though there’s a relative slowdown in global deal-making activity, the need for cloud-based solutions seems to only grow in years. Thus, the demand for virtual data room software is expected to grow as well. And despite global economic uncertainty, many corporate leaders do not plan to delay any business deals, which also proves the need for a secure data storage solution, such as virtual data rooms.

VDR solutions to consider

Ideals prioritizes robust security, offering features such as advanced encryption, customizable access permissions, watermarks, and two-factor authentication to ensure that sensitive information remains fully protected throughout the transaction process.

What sets Ideals apart is its exceptional customer care, with multilingual support available 24/7 to assist teams in real time during critical deal stages.

Securedocs is often used by startups and small to mid-sized companies for fundraising, M&A, and other document-heavy processes. The focus is on providing essential security and functionality without added layers of customization.

Admincontrol emphasizes usability and compliance, offering a structured environment for document exchange and decision-making between management teams, boards, and external stakeholders.

Virtual data room market segmentation

Now, let’s list the main segments in which the current virtual data room market is divided and define dominating segments in each type, based on the data presented in the report by Straits Research.

| Segmentation types | Segments | Dominating segment |

| By components | Solution Services | Solution: the global market is projected to grow at a CAGR of 12.2% in the 2023-2031 period. |

| By deployment type | On-premise Cloud | On-premise: the global market is expected to grow at a CAGR of 11.8% in the 2023-2031 period. |

| By user type | Large enterprises Small and medium enterprises | Large enterprises: the global market is forecasted to grow at a CAGR of 11.5% in the 2023-2031 period. |

| By business function | Finance Sales and marketing Legal and compliance Workforce management | Finance: the global market is expected to grow at a CAGR of 12.2% in the 2023-2031 period. |

| By industry vertical | Banking, financial services and insurance (BFSI) Energy and utilities IT and telecom Construction and real estate Healthcare Retail and e-commerce | BFSI: the global market is projected to exhibit at a CAGR of 11.2% in the 2023-2031 period. |

| By region | North America Europe Asia-Pacific sector LAMEA region (Latin America, the Middle East, and Africa) | North America: the market is forecasted to perform at a CAGR of 10.6% in the 2023-2031 period. |

Recent VDR market developments

Now, let’s have a brief look at the main events in the virtual data room industry that took place in recent years.

- TransPerfect acquired Sterling Technology

In August 2022, TransPerfect, a global provider of language and technology solutions for business, announced its acquisition of Sterling Technology, a leading Europe-based virtual data room provider. This is what Phil Shawe, a TransPerfect President and CEO, said about the deal: “We have admired Sterling’s strong reputation and leadership position in Europe. It is exciting to have them as part of our global team, and I have no doubt we will achieve great things for our clients. We welcome everyone at Sterling to the TransPerfect family.”

- Datasite opened a new office in Manchester (UK)

In September 2022, Datasite, the global virtual data room solution provider, announced it’s opening a new office in Manchester (UK). The main goal behind it was to “meet the UK’s growing demand for innovative M&A technology and services”. This is what Merlin Piscitelli, Datasite Chief Revenue Officer for EMEA, said about the opening: “Manchester and its surrounding region are a great fit for Datasite, and our new office ensures our international expertise and leading technology are on the doorsteps of M&A professionals in the North with on-the-ground resources to make the management of their deals even more effective and efficient.”

Key players of the VDR market

The current competitive landscape in the virtual data room market comprises the following virtual data room providers:

- Ideals

- Datasite

- Firmex

- Intralinks

- SecureDocs

- Ansarada

- Digify

- AdminControl

- Donnelley

- Citrix Systems

- Box

Each vendor offers different competitive services that ensure secure document sharing, effective collaboration, and productive project and business data management.

When selecting the most convenient virtual data room for your business needs, you should perform a comprehensive analysis of the key VDR players. For this, consider the main virtual data room comparison criteria:

- Variety of security measures

- Variety of data and project management tools

- Pricing model

- Quality of customer service

- Ease of use

- Compliance with the latest legal requirements and government regulations

- Real users feedback

Virtual data room market in 2024: Main trends and drivers for growth

Let’s briefly review the main trends and drivers for growth for the virtual data room industry in 2024.

AI demand

Recent statistics show that 30% of dealmakers see AI and machine learning as one of the key factors for the transformation of the M&A industry in the next 5 years. Such a demand for AI-powered solutions in M&A is most likely to be reflected in the virtual data room sector as well.

There are already virtual data room providers that offer certain AI-powered tools, and expectedly, their number or the variety of tools offered might grow.

Cybersecurity concerns

Constant technological advancements drive the need for serious measures in cybersecurity regard.

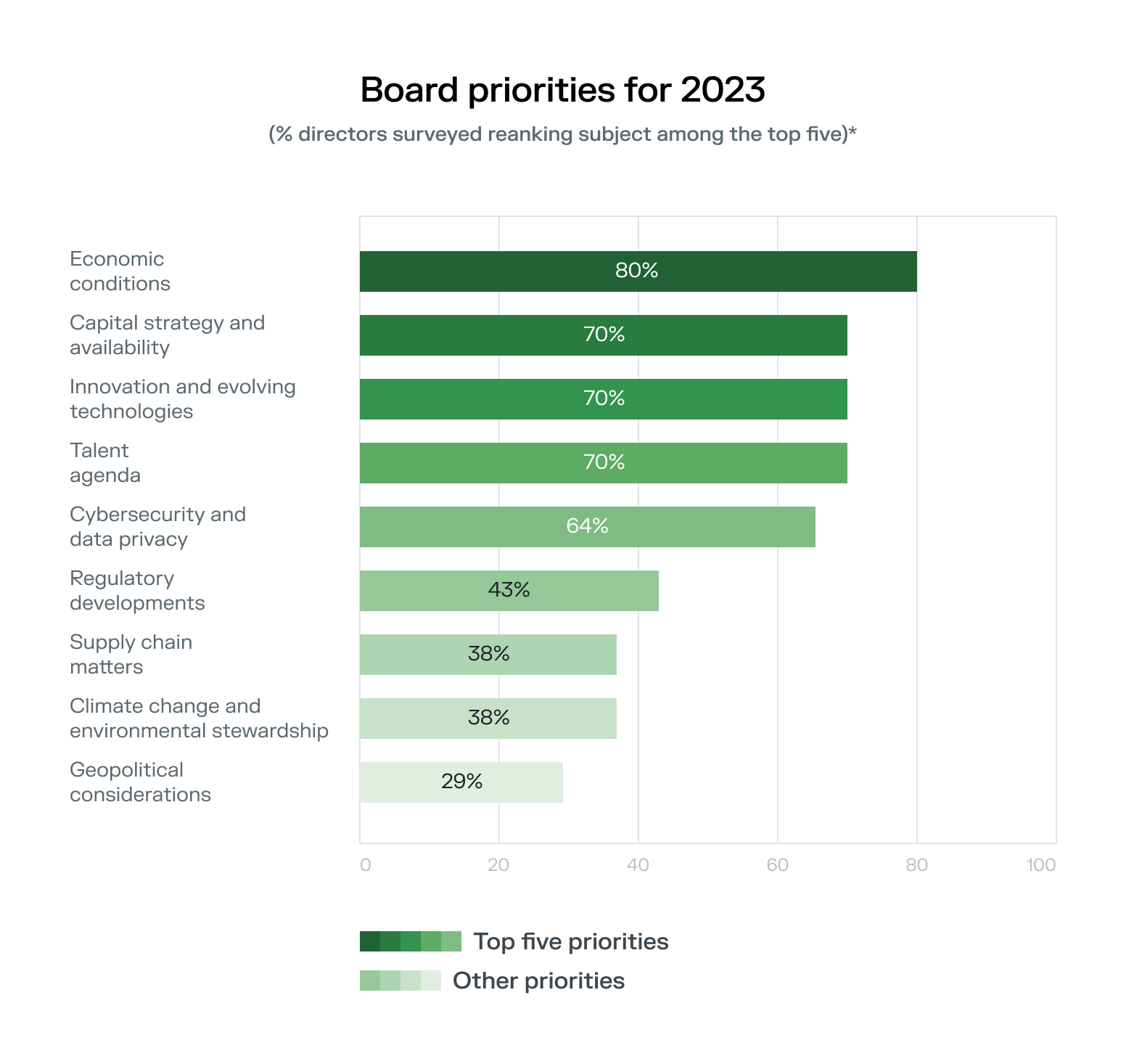

According to an Ernst & Young survey of the board of directors, 64% of respondents indicated that cybersecurity is the top board priority in 2023.

Source: Ernst & Young

What’s more, the average cost of a data breach amounted to $4.45 million in 2023, which is a 15% increase over three years, according to IBM.

Such attention to cybersecurity only intensifies with the ongoing Russia-instigated war in Ukraine: 15% of businesses increased their investments in cybersecurity, according to Deloitte.

Such figures speak volumes about the businesses’ need for a secure and controlled environment where they can store and share their sensitive data without risks.

Key takeaways

- The virtual data room market is estimated at about $1054.67 million in 2023 and is expected to reach $3742.5 million by 2032.

- The most dominating virtual data room market is in North America.

- The key players include Ideals, Datasite, Firmex, Intralinks, and SecureDocs.

- Among the main trends that are more likely to share the virtual data room market in 2024 are AI and rising cybersecurity concerns.