Virtual data room benefits for M&A & secure document management

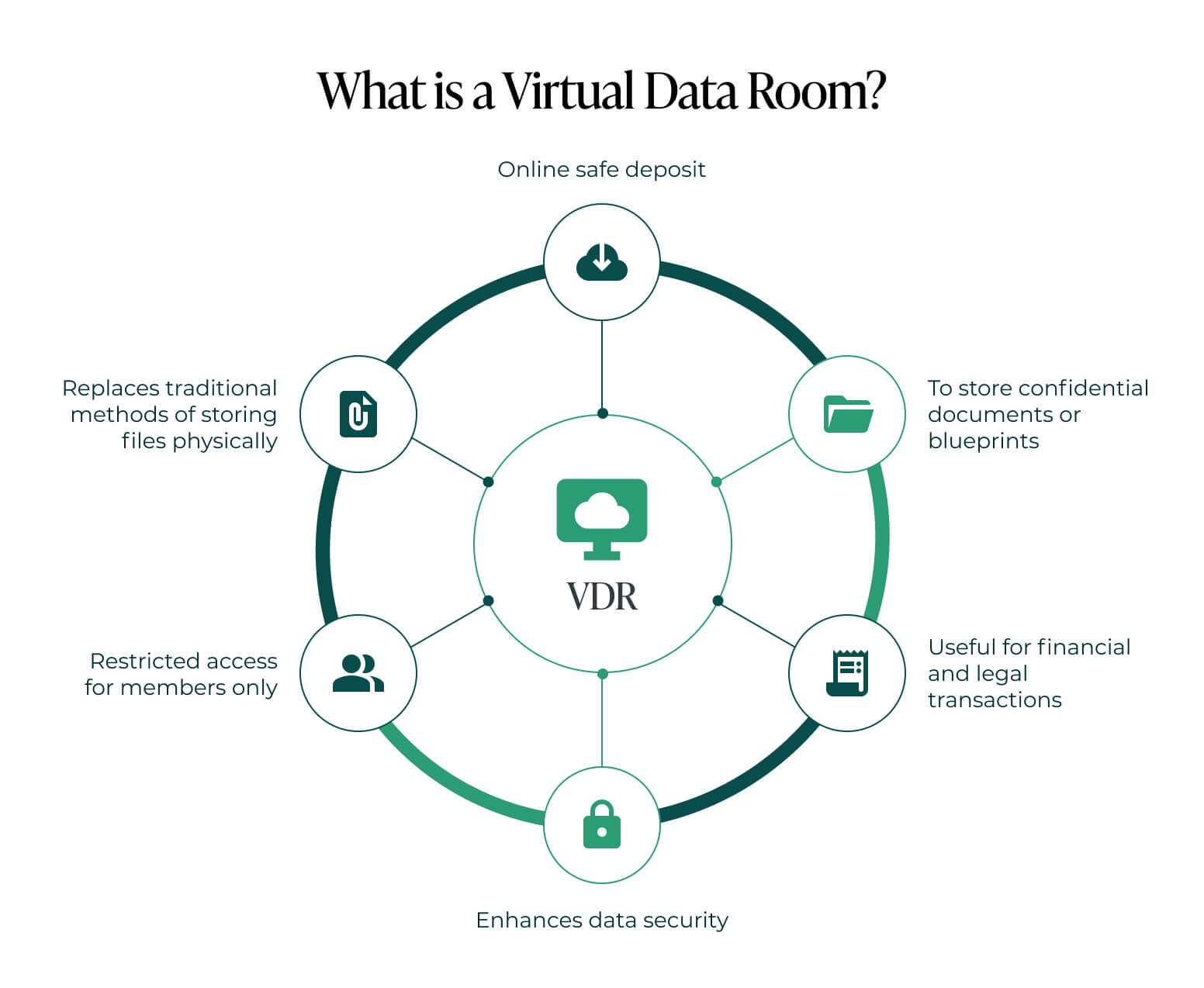

Historically, companies relied on physical data rooms to manage confidential documents, but that approach is no longer viable. The rise of virtual data rooms (VDRs) has completely changed how organizations handle sensitive data, offering better data security, enhanced collaboration, and faster deal closures.

This article explores the specific VDR benefits across M&A transactions and other types of deals.

Why companies use virtual data rooms

Virtual data rooms are more than just a digital tool — they’re a game changer for today’s deal management.

The specific features of each data room provider vary depending on the scope, size, and industry involved in the M&A transaction. However, all VDRs typically support essential tasks such as:

- Uploading and securely storing the client’s confidential documents.

- Granting authorized users access to the data room.

- Tracking user access and activity to evaluate the level of interest from multiple parties.

- Applying access controls to restrict certain files and folders based on user roles.

- Managing permissions for viewing, printing, or downloading specific files.

- Ensuring that users are unable to see other interested parties within the data room.

- Adding watermarks to files for extra security and to prevent unauthorized duplication.

In addition, most providers offer standard vdr features like:

- A customizable clickwrap NDA for secure agreements.

- Branding options for customizing the appearance of the data room.

- An integrated Q&A or messaging platform to handle inquiries directly within the system.

- Redaction and file updates.

- The ability to grant file access for a limited time, such as allowing downloads but revoking access post-transaction.

This combination of features ensures a controlled and secure process for managing confidential data throughout the transaction, no matter its complexity or size.

But how widely adopted across industries is a virtual data room? Let’s break down the VDR’s key use cases.

Mergers & Acquisitions (M&As)

M&As are one of the most common reasons for using VDRs, as data rooms allow for securely managing the high volume of sensitive information involved in M&A transactions. Whether on the buy-side or sell-side, VDRs ensure that all parties involved have controlled document access. Virtual data rooms offer features like access control, comprehensive audit trail, and advanced security protocols, which are critical for sharing sensitive documents securely and minimizing the risk of data breaches.

| Stage | Buyer Focus (Merger/Acquisition) | Seller Focus (Sale of Company/Assets) |

| Preparation | – Develop M&A strategy | – Conduct a strategic review |

| – Hire external advisors | – Prepare a business plan | |

| – Compile a list of potential targets | – Assess assets or businesses for sale | |

| – Research and analyze target companies | – Engage external advisors | |

| – Prioritize and shortlist targets | – Build a list of potential buyers | |

| – Evaluate acquisition proposals for strategic fit | – Prepare teaser and information memorandum | |

| – Gather due diligence materials and organize a data room | ||

| – Refine management presentations | ||

| Pre-Due Diligence | – Make initial contact with targets | – Reach out to potential buyers |

| – Sign confidentiality agreements | – Share information memorandum | |

| – Gather non-public data | – Set up a data room | |

| – Plan detailed due diligence | – Deliver management presentations | |

| – Decide on a preliminary offer | – Circulate draft agreements | |

| – Form and organize the due diligence team | – Collect preliminary offers | |

| Due Diligence | – Inspect data room and review documents | – Prioritize letters of intent |

| – Analyze confidential documents | – Shortlist potential buyers | |

| – Assess risks, returns, and prices | – Set offer submission deadlines | |

| – Structure transaction terms | – Assist with data room access | |

| Negotiation | – Lead negotiations | – Compile and assess final offers |

| – Present the final offer | – Select the best offer | |

| – Reach an agreement | – Finalize terms and conditions | |

| Closing | – Disband the due diligence team | – Terminate the data room |

| – Execute the agreement and arrange for compensation transfer | – Finalize ownership transfer |

The table above outlines the typical activities each party undertakes during the various phases of an M&A deal. From the early preparation stages to the final closing of the transaction, both parties rely on VDRs to provide a secure environment for document management, collaboration, and due diligence.

Due diligence

The due diligence process is critical for ensuring a successful M&A transaction, with nearly 20% of executives identifying it as the most important factor for deal success. Unlike aspects such as cultural fit or management adaptability, which are difficult to standardize, due diligence can be systematically improved using technology. Virtual data rooms offer features like detailed audit trails and access control, enabling companies to manage the exchange of documents securely.

Fundraising

Whether it’s for startups or large corporations, virtual data rooms provide a secure environment for sharing financial records, strategic plans, and legal documents with potential investors.

This secure file sharing enables 24/7 document access from anywhere, allowing authorized users to review documents without compromising security. Additionally, a free data room trial can be a cost-effective way for smaller businesses to test the features before committing to a subscription.

Legal Proceedings

In the legal world, where confidential information must be handled carefully, VDRs offer robust security features such as document expiry settings, permission settings, and control access. This ensures that confidential data remains protected during litigation and other essential processes.

Initial Public Offerings (IPOs)

Companies preparing for an initial public offering rely heavily on VDRs to streamline the due diligence process. Virtual data rooms allow businesses to share important documents with potential investors and regulators in a controlled manner, ensuring enhanced security and regulatory compliance.

The core benefits of virtual data rooms

Now, let’s take a closer look at why companies are choosing virtual data rooms over traditional data rooms.

1. Top-notch security

Security is at the heart of any virtual data room. With advanced security measures like two-factor authentication, advanced encryption, and detailed activity tracking, VDRs ensure that only authorized users can access files. Compared to physical data rooms, VDRs offer superior document security and data protection. Compliance with regulatory requirements like ISO 27001 and GDPR guarantees that sensitive data remains secure.

2. Anytime, anywhere access

One of the biggest VDR benefits is the ability to access files from any location with an internet connection. Unlike physical data rooms, where physical documents require in-person review, VDRs provide multiple parties with real-time access. This is especially valuable in fast-paced M&A deals and due diligence processes, where delays can jeopardize a transaction.

3. Streamlined due diligence

The due diligence process is often the most time-consuming part of M&A. Virtual data rooms allow companies to organize and share specific documents in a secure and structured way, making it easier for authorized users to review documents. Businesses can also track which documents have been accessed, how long they were viewed, and whether any concerns need to be addressed.

4. Significant cost savings

Switching from physical to virtual data rooms brings about substantial cost savings. Traditional data rooms can incur high expenses for information storage, security, and management. On the other hand, VDRs offer cost-effective solutions that eliminate these overheads, allowing businesses to reduce their data storage costs by up to 30%.

5. Enhanced collaboration

In any complex transaction, collaboration between multiple parties is essential. VDRs provide collaboration tools like real-time editing, commenting, and Q&A features, helping multiple parties share documents and discuss confidential information securely. Moreover, VDRs reduce time spent on essential business processes by up to 40%, which contributes to the efficiency of closing deals.

Virtual data rooms vs. physical data rooms

Here’s a comparison to highlight why virtual data rooms are preferred over physical ones:

| Feature | Virtual Data Rooms | Physical Data Rooms |

| Security | Advanced security features, access control | Limited document security |

| Accessibility | 24/7 global document access | Restricted to specific locations |

| Cost | Subscription-based, cost-effective | Expensive to maintain and secure |

| Due Diligence Time | Reduced by 40% | Time-consuming document access |

Ideals: A leading virtual data room provider

Ideals stands out as a top provider in the virtual data room space, particularly for complex transactions.

What sets Ideals apart is its dedicated 24/7 multilingual support, ensuring minimal downtime for users during high-stakes deals.

While competitors like Datasite, SecureDocs, and Intralinks provide similar services, Ideals excels in exceptional customer service, making it a go-to solution for M&A professionals across 90+ countries.

Some additional standout features of Ideals VDR include:

- Detailed audit trail

- Built-in redaction

- Advanced Q&A module

- Auto-notifications for new activity

- eight levels of granular access controls

- 30-second chat response time

- 30-day full-functionality free trial

FAQ

A virtual data room (VDR) is a secure online platform for information storage and sharing, often used during M&A transactions, legal proceedings, and audits.

While both provide centralized storage for secure file sharing, VDRs are built for sensitive documents and offer advanced security features such as encryption, access controls, and audit trails.

VDRs offer robust security measures, including encryption, two-factor authentication, and detailed audit trails, ensuring that sensitive data always remains secure.