M&A data room: structure and benefits

In 2022, the total M&A deal volume was estimated at $3.8 trillion. While experts foresee a slight decline in deal-making activity, the PWC M&A trends report anticipates more deals by the end of 2023.

With such intense M&A deal activity, the demand for a reliable and secure platform for secure file sharing and storing is only growing. And this need is fully covered by a virtual data room (VDR).

Continue reading to learn what is an M&A data room and how virtual data rooms make M&A and the due diligence process more straightforward and efficient.

Key takeaways:

- An M&A virtual data room is a data room used specifically during mergers and acquisitions.

- Usually, virtual data rooms are used during three stages of M&A: exploratory, due diligence, and post-merger integration phases.

- The process of structuring a virtual data room for M&A typically includes setting up a structure, organizing the data room index, managing access permissions, and uploading required files.

- The main benefits of virtual data rooms for M&A are security, centralization, improved accountability, convenience, and cost reduction.

- The best practices for M&A virtual data room organization include creating the due diligence data room checklist, naming files and folders according to corporate guidelines, labeling files and folders, enabling available security features, and updating documents regularly.

What is a data room for M&A?

An M&A virtual data room is basically a data room used specifically for the needs of mergers and acquisitions. It provides a secure online repository for storing and sharing confidential documents required during M&A transactions limiting the risk of disclosure or breach.

A virtual data room M&A is used primarily during due diligence. It allows the target company to prepare and structure all the documents required by an acquirer to review. These include sensitive documents such as financial statements, contracts, intellectual property records, marketing research data, and product information.

M&A data room providers offer all the features to make the M&A stages smooth, more secure, and more efficient. This is what customers of iDeals virtual data room say about using it for conducting M&A transactions:

| “It’s a super versatile and robust system. Our company has used it to conclude 3 multimillion euro/dollar M&A transactions (and currently in the process of 3 more). If there ever has been an issue or question with something, the support team has always been available to handle the query immediately. Particularly, you know the product is good when the support team takes recommendations for features and asks for more details on how certain features are used, etc.” |

When is the virtual data room used during M&A?

Generally, virtual data rooms can be used during three main stages of an M&A transaction.

| M&A stage | How VDR can facilitate the process |

| Exploratory | – Quick upload of volumes of documents via drag-n-drop and bulk upload feature – No extra files preparation is needed as VDRs support multiple file formats – Increased time-efficiency due to the automatic index numbering – Ready-to-use due diligence checklists that eliminate risks of missing essential documents – Quick files search with full-text search and optical character recognition |

| Due diligence | – Files and folders labeling that facilitates investors’ navigation – Enhanced security of confidential data due to in-built redaction, fence view, and watermarking – Full control of third parties access rights thanks to granular user permissions – Q&A workflows that enable effective communication between dealmakers and quick issues solving – Branding features that help target companies to stand out |

| Post-merger integration | – Ability to assign tasks for particular experts to work on the deal’s completion – Granular access to threads so that only responsible parties could cooperate on certain issues – Detailed reporting that enables to get the full picture of how the post-integration process is evolving and detect weak areas that require attention – Ability to work on multiple projects simultaneously, which facilitates the deal closure – Highly secure infrastructure which is presented by strong password policies, two-factor authentication, and custom NDAs that ensure all the critical data is protected |

Now, let’s shortly review what each stage is about.

Exploratory phase

This stage presupposes getting ready for the prospective due diligence. For this, the seller prepares all the pre-marketing materials required for potential buyers to review and gathers them in the secure online space of a virtual data room.

Due diligence phase

During the due diligence process, potential investors review such target’s confidential documents as financials, historical data, compliance documentation, and marketing materials. And virtual data room providers make this process more straightforward and effective. Moreover, virtual data room solutions enable productive collaboration between the parties involved with the help of such dedicated services as Q&A sections, which significantly accelerates the deal.

Post-merger integration phase

When two companies merge, many confidential documents and internal processes must integrate. The integration process goes much smoother when using virtual data room software as a corporate document repository. The variety of dedicated document management features, collaboration tools, and enhanced security measures ensure protection for sensitive data and effective corporate cooperation.

How to structure a data room for an M&A transaction?

Correct and well-thought-out M&A data room structure can often become one of the key factors of the deal’s success. When deal documents are organized logically and updated regularly, potential buyers are more likely to have fewer questions.

So what should you, as a potential seller, do to structure a data room in a way to make merger and acquisitions go better?

1. Draw a scheme of how an online data room should look like

This can be anything from a rough draft on paper to a detailed schematic in graphics editing software — whatever suits you. What matters here is to have a concrete understanding and visual representation of how a virtual data room should look. This is important as it gives insight into what potential buyers would expect to see in an online data room and allows for making a data room structure more logical for them.

2. Organize data room index

Due diligence processes typically involve large volumes of sensitive documents. That’s why structuring a virtual data room for M&A logically is essential.

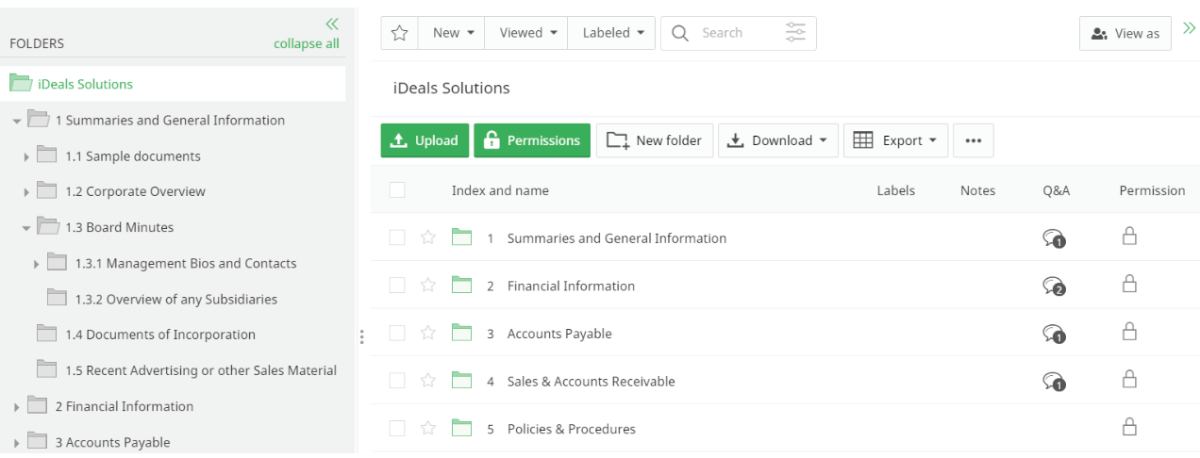

Admins can create a clear and intuitive index or opt for the automatic index numbering feature most online data room providers offer. It automatically structures files and folders uploaded into the digital data room in just a few moments. With traditional data rooms, logical document structuring could take hours or days.

The following is an example of how documents and folders could be organized after automatic index numbering in an iDeals virtual data room.

3. Manage user access

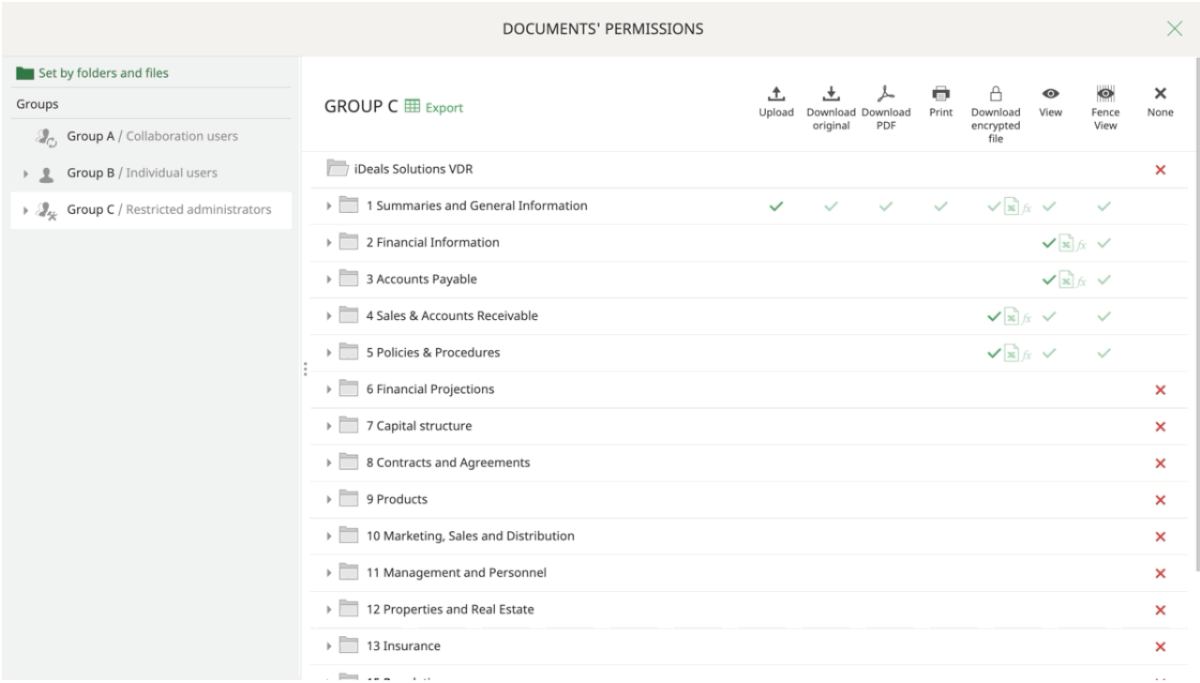

Data security is of paramount importance when it comes to conducting such complex financial transactions as mergers and acquisitions. That’s why it’s essential for an administrator to ensure VDR users have access only to the files they require.

Managing access permissions is important to take care of when structuring a data room. This is because you should know who must have access to what in the deal’s early stages and to make sure that those users can see and access files effortlessly.

Administrators can configure document access based on user groups or file/folder types, and even entirely restrict access to particular users.

For example, this is how managing access permissions looks like in an iDeals virtual data room.

4. Upload required files

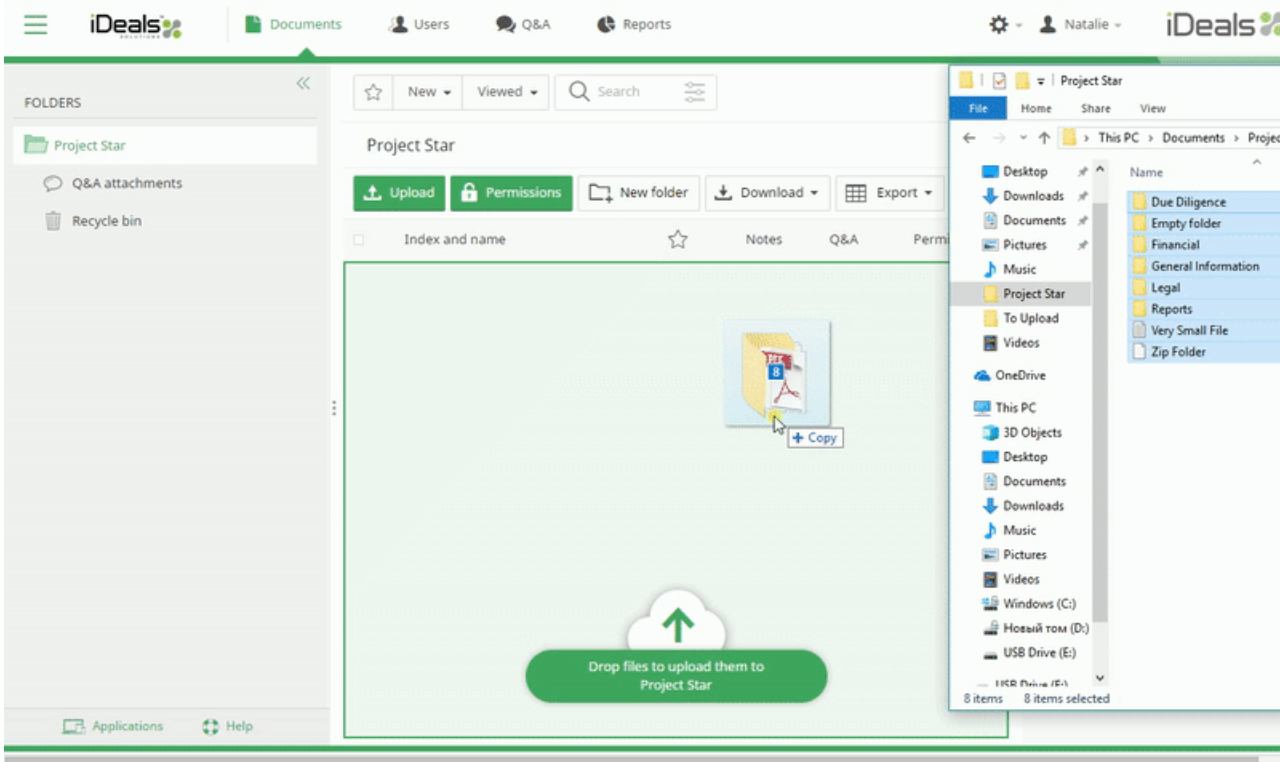

The last step of structuring a data room for the M&A process is to upload all required sensitive data.

Considering the volume of documents needed for the due diligence process, uploading could be very time-consuming. However, online data rooms eliminate this by offering dedicated data management features such as drag-n-drop and bulk upload.

For instance, this is how the drag-and-drop functionality appears in an iDeals virtual data room.

Benefits of using virtual data rooms for mergers and acquisitions

The best virtual data room for M&A can make the due diligence process smoother and accelerate decision-making. The following are among the top advantages that virtual data rooms provide.

Security

Security is the top benefit VDRs provide and is of the top importance when it comes to such complex financial transactions as mergers and acquisitions.

Virtual data rooms ensure a high level of data protection on all M&A stages thanks to such features as built-in redaction, dynamic watermarking, fence view, granular user permissions, two-factor authentication, the ability to monitor users’ activity, and remote shred.

Virtual data room providers help companies to:

- Minimize human error. According to a 2014 study by IBM, human error is a reason for data breaches in a shocking 95% of cases. Despite the survey’s outcomes that human errors usually come from insiders, it’s usually an innocent human mistake rather than an intended malicious action. Virtual data rooms help to avoid such situations thanks to the complete control an administrator has over users’ access rights and detailed reports on users’ activity.

- Reduce the risk of hacks. Phishing emails are usually the reason for about 91% of cyberattacks against large corporations. Obviously, critical data sharing over email isn’t safe when it comes to such complex financial transactions as M&A. Virtual data rooms enable on-site secure collaboration inside a secure environment, which significantly reduces the risks of hacker attacks.

- Encrypt communication. Statista’s 2021 survey on the use of enterprise encryption technologies worldwide has shown that about 60% of respondents have encryption extensively employed on their company’s archives and backup, while only 35% have deployed encryption technologies to emails. Logically, email isn’t a reliable way to discuss such critical data as clinical trial findings and other intellectual property issues. On the other hand, virtual data rooms offer dedicated forums for the safe communication of all parties involved in the project — from lawyers to accountants.

Convenience

About 80% of companies use SaaS solutions in their business operations. Naturally, this is because of the opportunities the ease of use of SaaS products offer.

Compared to traditional physical data rooms that are time-consuming to set up and visit and often provide limited access, every virtual data room provider is available 24/7 and from anywhere. Being a SaaS-based solution, virtual data rooms are cloud-based and can be accessed from any browser. This means that multiple parties can view documents during the due diligence process simultaneously, which significantly saves time and accelerates the deal.

Centralization

45% of employees from companies that have more than 500 employees believe that effective internal communication is the key to successful management. The same corresponds to dealmaking — being able to manage all the due diligence tasks in one place significantly facilitates deal completion.

A virtual data room serves as a centralized solution to conduct all due diligence processes in one place. Virtual data rooms not only enable secure file sharing and storing but also allow you to effectively collaborate on documents with investment bankers and other interested parties.

Improved accountability

According to Forbes, poor communication during due diligence is one of the reasons why deals fail. Timely reaction to a bidder’s request can always save the deal, that’s why it’s important to be aware of all the processes that happen during due diligence.

Virtual data room providers allow tracking users’ activity with the help of such reporting tools as audit trail and user activity tracking. This is especially important when conducting due diligence and cooperating with multiple parties since it allows for the timely identification of bidders’ interests so that the seller can react proactively.

Cost reduction

According to the IBM Cost of a Data Breach 2022 Report, the average cost of a data breach has increased by 2.6% from $4.24 million in 2021 to $4.35 million in 2022. Poor security measures are what make companies pay more.

At first glance, virtual data rooms might seem similar to traditional cloud storage solutions. However, when using the usual cloud storage for M&A, you might pay double for average security measures. Virtual data rooms may be slightly more costly than cloud storage, but it is a cost-effective file-sharing solution considering the high level of security provided.

M&A data room best practices

To get the most out of structuring a secure virtual data room for M&A and to make this process even more effective, take the following tips into consideration.

1. Create a due diligence checklist

Construct a customized due diligence checklist or opt for one offered by the data room provider. Most virtual data rooms offer due diligence checklist templates, which significantly simplify the process of preparing for the deal. So if this functionality is important for you, search for it when you compare virtual data rooms.

In the case where no due diligence checklist template is offered, users can take care of easily creating one for themselves. Having a checklist eliminates the chances of forgetting to add some crucial documents.

2. Name files and folders following the corporate file naming system

Sometimes, companies are required to follow certain corporate standards and requirements for document organizations. If that’s the case, then it’s critical to pay special attention to naming files and folders when structuring confidential data in the virtual data room.

3. Label folders

Folder labels allow users to find concrete files quickly and easily. For example, if potential buyers need information about the current company’s employees, they should probably look for the “HR” or “Employees” label.

It’s also worth mentioning that the best virtual data rooms use optical character recognition (OCR) technology, which enables full-text search. Therefore, with the help of full-text search and document labels, virtual data room users can find a desired document with just a few clicks.

4. Enable available security features

To ensure secure document sharing, use the available virtual data room services when uploading confidential documents. The most common document security features include redaction, watermarking, fence view, remote shred, or granular user permissions. This is something a physical data room can’t provide.

5. Take care of regular updates

Due diligence can often be a long-term process; therefore, some documents might become outdated while still being reviewed. That’s why the seller should always be engaged in making sure all the files are up-to-date and be ready to adjust the data room structure when the need for changes arises.

FAQ

Though multiple parties have access to the virtual data room for M&A, including sellers, buyers, investment bankers, and lawyers, the VDR space is controlled by the administrator. Typically, it’s an administrator from the sell-side or investment bank.

Among the documents to include in a virtual data room for M&A are financial statements, taxes information, intellectual property documents, supplier documents, marketing materials, and a list of current shareholders, directors, and officers.

A virtual data room for M&A is basically a data room used specifically during mergers and acquisitions. Such virtual data rooms ensure secure file sharing and effective collaboration among multiple parties during the due diligence process.

The process of structuring a data room for M&A may differ depending on the deal and the company’s specifics. However, among the most common steps are drawing a schematic diagram of what to include in a virtual data room, organizing the data room index, managing users’ access, and uploading files.